Many wonder if DACA recipients have to pay federal taxes. If you're a Dreamer yourself, you may also wonder if you should file your taxes every year the way American citizens do.

Read on to find out everything you need to know about filing taxes as a DACA recipient and tips to make sure you do it right.

What is DACA?

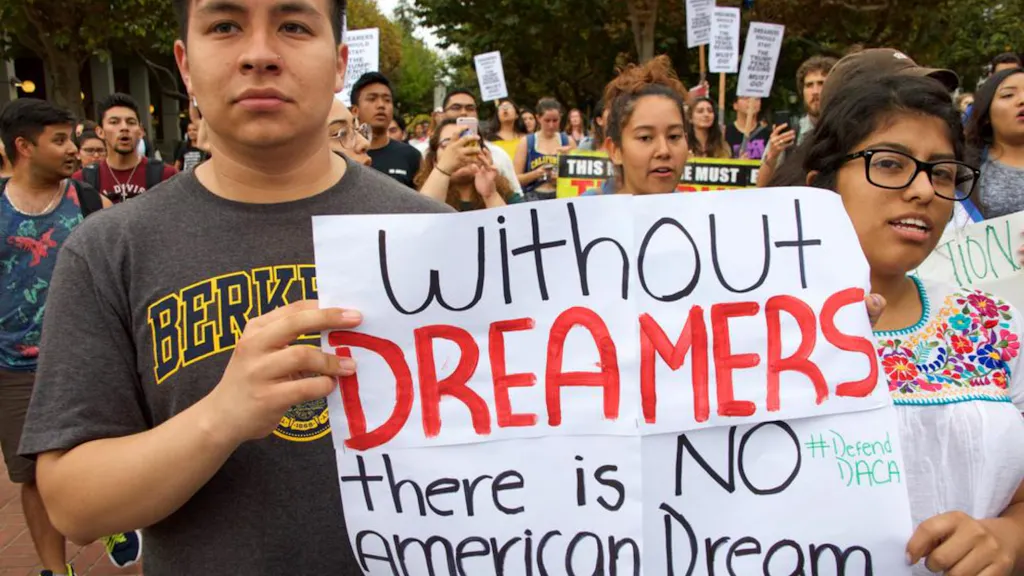

Deferred Action for Childhood Arrivals (DACA) is an American immigration policy aimed at eligible teenagers and young adults who were brought to the United States outside of their control as children. Recipients of DACA, also known as Dreamers, are granted temporary deferral from deportation as well as legal work authorization.

Are DACA recipients required to file taxes?

You may be wondering if DACA recipients have to pay taxes.

The short answer is yes. Anyone enrolled in DACA must file and pay taxes.

However, the long answer is a little more complex. The truth is that everyone living in the United States pays taxes in some way, whether it’s through sales tax for purchasing goods or property tax directly by owning property or indirectly by renting.

The difference is that DACA provides young migrants with the ability to work and temporary social security numbers, which means they are responsible for the same federal, state, and local taxes that citizens must pay.

So, again, yes–Dreamers pay taxes.

Quick facts about DACA and taxes

- The most recent data from US Customs and Immigration estimates that there are approximately 652,880 active DACA recipients as of September 2019.

- Dreamers pay on average 8.3% of their income in state and local taxes, which is higher than the average rate paid by the top 1% of taxpayers and is about equal with the average rate paid by the middle 20% of taxpayers.

- Exactly how much did Dreamers pay in taxes? In 2019, Dreamers paid $5.7 billion in federal taxes and $3.1 billion in state and local taxes.

When is the deadline to file taxes?

Anyone working in the United States is required to file a tax return on a yearly basis. The deadline to file taxes is April 15th, unless the 15th falls on a weekend or holiday in which case the deadline is the following business day.

Tax returns are registered by the Internal Revenue Service (IRS).

Is there any risk in filing taxes as a Dreamer?

No! The IRS does NOT share taxpayer information with other government agencies.

Therefore, DACA recipients should not be afraid to file their taxes. In fact, it may help them in any future immigration cases in which they are required to prove tax compliance, proof of income, or proof of residence.

Everyone must file their taxes for the previous year’s income. For example, you will file taxes for 2019 by April 15th, 2020.

How do DACA recipients file their taxes?

There are three ways in which Dreamers can file a tax return:

Manually–fill out the forms provided directly by the IRS and return the completed forms and necessary documentation to the IRS before the deadline. This would not be recommended for first time taxpayers or those who are unsure about how to file. Most citizens do not even use this method.

Tax software/website–purchase or log in to an online tax program. These programs will walk you through filing your taxes step by step. Some even help you file for free. This is a great alternative for inexperienced filers to submit their tax return in an easy and affordable way. Most online services, such as TurboTax, offer services in both English and Spanish and are very popular.

Professional help–visit an accountant or tax preparer who will give you one-on-one advice and assistance preparing a tax return for you and your family. If you speak with an experienced professional, you can make sure your taxes are done correctly. However, this is the most expensive option in most cases.

Are DACA recipients eligible for tax credits?

A tax credit is a sum of money that taxpayers can subtract from the total amount they owe in taxes to the government. Credits are granted based on meeting specific requirements.

DACA recipients are eligible to receive tax credits, including the Child Tax Credits, the Child and Dependent Care Credit, and the American Opportunity Credit.

That being said, the Affordable Care Act (ACA) mandate does not apply to DACA recipients; therefore, they do not qualify for the Premium Tax Credit. They are also not subject to the penalty for not having health insurance.

FYI

The Affordable Care Act, sometimes referred to as ObamaCare, provides individuals with government-subsidized healthcare.

Tax returns and payments

After completing your tax return, you will either get money back or have to pay additional taxes.

The amount you owe does not include what you have to pay for an accountant or tax preparation program to help you complete your return.

If you owe money, you must make the payment to the IRS when you submit your return. If you can’t afford it, you can request a payment plan to pay back the tax in installments.

If you are entitled to money back (yay!), you can select how you would like to receive the money, usually by a check or direct deposit to your bank account.

Don’t have an account?

Become a MAJORITY member so that the IRS can deposit your return directly into your MAJORITY account, which means you get your money back faster!